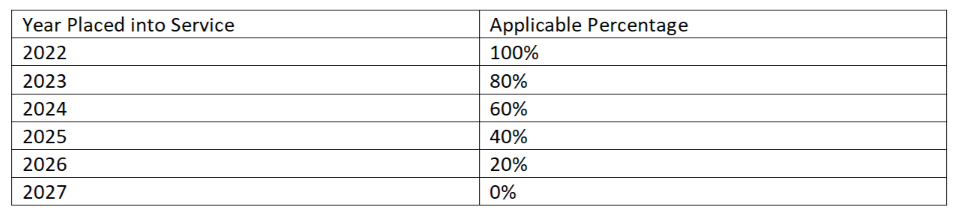

As we have been rushing through this end of year madness there has been a new sense of urgency due to the scheduled phasedown of bonus depreciation. To be clear, bonus depreciation is not ending on January 1, 2023. There is a scheduled phasedown that was included in the Tax Cuts and Jobs Act of 2017 (“TCJA”). Throughout the history of bonus depreciation we have seen various legislation that has increased, decreased, extended and/or phased-out bonus depreciation. As it stands now, below is a summary of the scheduled phasedown of bonus depreciation pursuant to the TCJA:

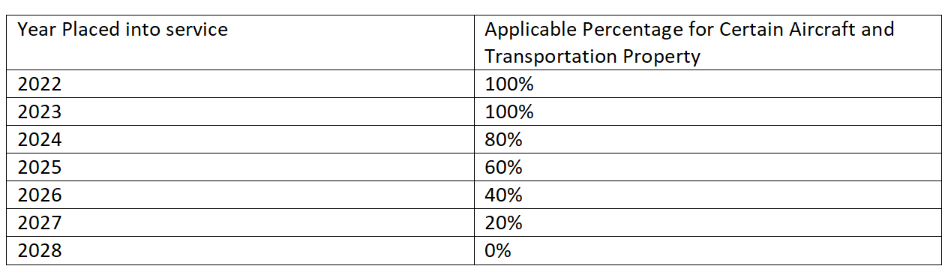

In addition to the percentages shown above, there is a one-year delay in the phasedown percentage for Certain Aircraft and Transportation Property. Certain Aircraft and Transportation Property are both defined in the TCJA. As a result, many aircraft transactions in 2023 will still be eligible for 100% bonus depreciation. In the alternative, the worst-case scenario for 2023, is that if an aircraft does not meet the definition of Certain Aircraft and/or Transportation Property, then the bonus depreciation amount available will be 80%.

In addition to the percentages shown above, there is a one-year delay in the phasedown percentage for Certain Aircraft and Transportation Property. Certain Aircraft and Transportation Property are both defined in the TCJA. As a result, many aircraft transactions in 2023 will still be eligible for 100% bonus depreciation. In the alternative, the worst-case scenario for 2023, is that if an aircraft does not meet the definition of Certain Aircraft and/or Transportation Property, then the bonus depreciation amount available will be 80%.

As has always been the case, just because an aircraft purchased by a buyer is eligible for bonus depreciation, that does not mean that the buyer automatically qualifies to take the bonus depreciation. The intended use of the aircraft (business vs. personal; within the United States or outside of the United States) and the specific tax situation of the buyer will need to be closely reviewed to determine eligibility to take bonus depreciation.

As has always been the case, just because an aircraft purchased by a buyer is eligible for bonus depreciation, that does not mean that the buyer automatically qualifies to take the bonus depreciation. The intended use of the aircraft (business vs. personal; within the United States or outside of the United States) and the specific tax situation of the buyer will need to be closely reviewed to determine eligibility to take bonus depreciation.

It is important to always remember that a key step when purchasing an aircraft is the development and implementation of an aircraft ownership and operating structure and tax plan, both at the federal level and state level, which should be in place prior to closing and followed after closing.