The most common first step in the acquisition of an aircraft is for one of the parties, usually the buyer, to prepare and submit a letter of intent (“LOI”) to the other party. The main reason for using an LOI is to express each party’s understanding of the key business terms of the transaction and to commit to those terms in writing. The LOI confirms that the parties have reached a meeting of the minds on the key business terms. Generally, unless there are extenuating circumstances, the LOI should not be skipped, otherwise more time and effort may be expended on the negotiation of a full agreement before the parties realize they do not have a deal.

For the purchase and sale of an aircraft, the LOI is usually a short, two or three page document that includes the essential terms (identified below) of the deal. The LOI usually includes a provision requiring that the buyer submit a deposit to a specific escrow company within a certain number of days after the execution of the LOI. Additionally, the LOI usually contains a provision that it will terminate and be of no further effect if the final aircraft purchase and sale agreement (“APSA”) is not executed by a certain date.

Given that the LOI is subject to the completion of an APSA and is usually non-binding, the obligation of the parties under an LOI often may be more of a symbolic commitment than a legal commitment. In almost all aircraft LOIs, the deposit is fully refundable, which means the buyer could change her mind at any time and receive a full refund of the deposit. If the LOI is non-binding or the APSA is not agreed upon by the required date, the seller can sell the aircraft to someone else if a better deal comes along. Since the intent of the parties is not always easy to determine and the cost of litigation can be prohibitive, it is in the parties’ best interests to remove any ambiguity from the LOI and clearly state their intentions. It is paramount that the LOI state which sections of the LOI, if any, are intended to be binding on the parties or that the entire LOI is non-binding.

Is the LOI necessary? Yes, it is the best way to start the aircraft purchase and sale process to make sure the parties agree on the key business terms before spending the time and effort to prepare the full APSA. A list of the key business terms to include in the LOI is as follows:

1. Name of the buyer and seller

2. Purchase price

3. Deposit amount and number of days to remit deposit after LOI is signed

4. Escrow agent

5. Visual inspection requirements (if visual inspection has not already taken place), if any

6. Scope of pre-purchase inspection

7. The facility conducting the pre-purchase inspection and at which location

8. Purchaser’s rights to accept or reject the aircraft after the inspection (for any reason or only if significant findings)

9. Definition of discrepancies and seller’s responsibility regarding same

10. Flight cost allocation for all relevant flights

11. Aircraft delivery conditions

12. Closing process (number of days to close after discrepancies have been remedied)

13. Number of days to agree on the final APSA and which party will draft the initial version of the APSA

14. Non-binding statement except for certain key terms

15. No- Shop provision, if applicable

16. Typical miscellaneous provisions (choice of law, confidentiality, assignment rights, deadline for acceptance, taxes, international registry requirements)

The decision to use a LOI or omit the LOI step is a question that should be evaluated with regard to each deal, the parties involved, and considering all the other variables involved so that a strategic, well-informed determination can be made. Most often the LOI should be the first step in the aircraft purchase and sale process and should not be skipped.

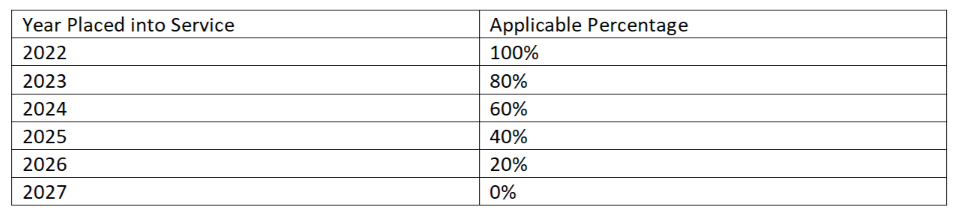

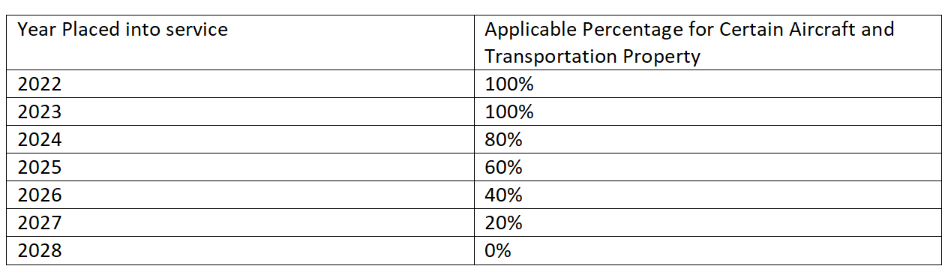

In addition to the percentages shown above, there is a one-year delay in the phasedown percentage for Certain Aircraft and Transportation Property. Certain Aircraft and Transportation Property are both defined in the TCJA. As a result, many aircraft transactions in 2023 will still be eligible for 100% bonus depreciation. In the alternative, the worst-case scenario for 2023, is that if an aircraft does not meet the definition of Certain Aircraft and/or Transportation Property, then the bonus depreciation amount available will be 80%.

In addition to the percentages shown above, there is a one-year delay in the phasedown percentage for Certain Aircraft and Transportation Property. Certain Aircraft and Transportation Property are both defined in the TCJA. As a result, many aircraft transactions in 2023 will still be eligible for 100% bonus depreciation. In the alternative, the worst-case scenario for 2023, is that if an aircraft does not meet the definition of Certain Aircraft and/or Transportation Property, then the bonus depreciation amount available will be 80%. As has always been the case, just because an aircraft purchased by a buyer is eligible for bonus depreciation, that does not mean that the buyer automatically qualifies to take the bonus depreciation. The intended use of the aircraft (business vs. personal; within the United States or outside of the United States) and the specific tax situation of the buyer will need to be closely reviewed to determine eligibility to take bonus depreciation.

As has always been the case, just because an aircraft purchased by a buyer is eligible for bonus depreciation, that does not mean that the buyer automatically qualifies to take the bonus depreciation. The intended use of the aircraft (business vs. personal; within the United States or outside of the United States) and the specific tax situation of the buyer will need to be closely reviewed to determine eligibility to take bonus depreciation.